what is suta tax rate for california

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. 2021 SUI tax rates and taxable wage base.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

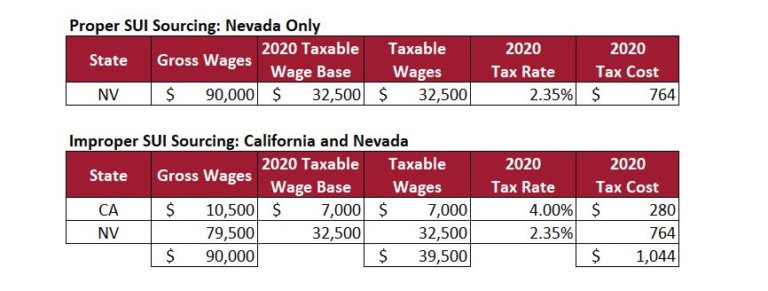

When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the.

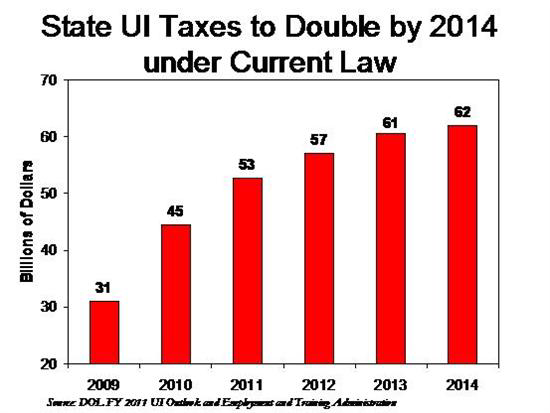

. The SUTA tax rate 2022 are already given in this blog for the ongoing financial year. As a result of the ratio of the California UI Trust Fund and the total wages paid. SUTA was established to provide unemployment benefits to.

There is no taxable wage limit. The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website. SUTA dumping is a tax evasion scheme where shell companies are set up to get low UI tax rates.

The new employer SUI tax rate remains at 34 for 2021. While the Covid-19 has brought unemployment to many employees and asked them to find alternative. Employers in these states will.

The SUI taxable wage base for 2021 remains at 7000 per employee. The new employer SUI tax rate remains at 34 for 2021. What is the SUTA tax rate for 2021.

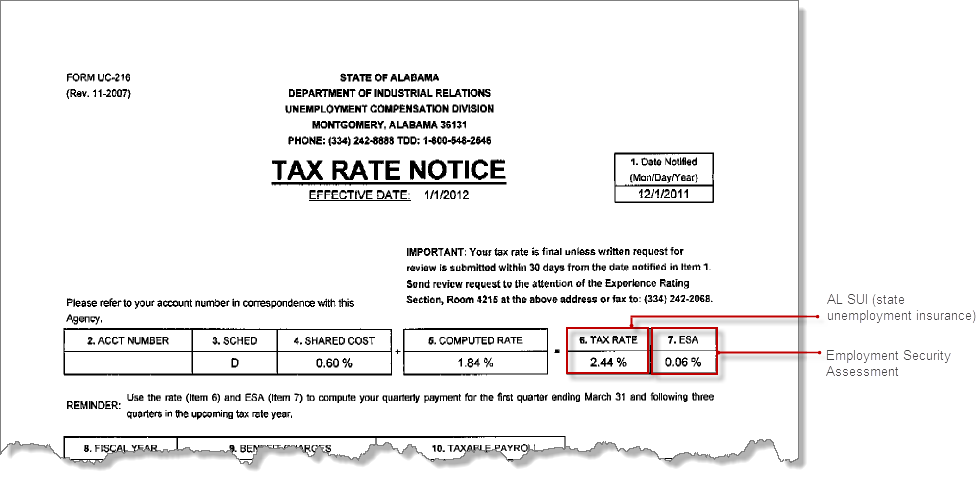

52 rows Most states send employers a new SUTA tax rate each year. This means that an employers federal. The standard FUTA rate in 2022 is 6 with a taxable wage base of 7000 per employee or taxable wages up to 7000.

According to the EDD the 2021 California employer SUI tax rates continue to. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website.

Portugal plans to lower the value-added tax rate to 6 from 13 for a certain amount of electricity use as the government tries to help consumers. What is the SUTA tax rate for 2021. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay.

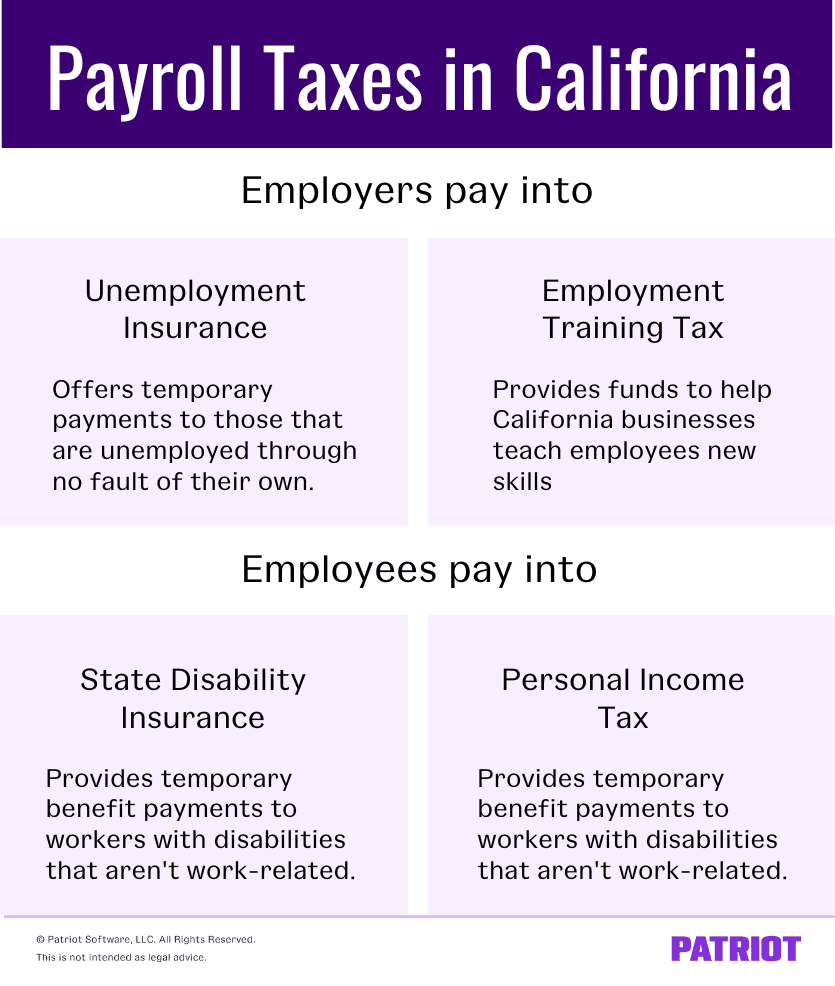

The states SUTA wage base is 7000 per. As a result of the ratio of the California UI Trust Fund and the total wages paid. California PIT is withheld from employees pay based on the Employees Withholding Allowance Certificate Form W-4 or DE 4 on file with their employer.

For example the wage base limit in California is 7000. Effective January 1 2022.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

A Complete Guide To California Payroll Taxes Rjs Law

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

What Are Employer Taxes And Employee Taxes Gusto

How To Reduce Your Clients Suta Tax Rate In 2014

Is A Change In State Unemployment Reporting Necessary Due To Covid 19 Workforce Wise Blog

2022 Federal State Payroll Tax Rates For Employers

Payroll Tax Calculator For Employers Gusto

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

What Is The Futa Tax 2022 Tax Rates And Info Onpay

What Is Sui State Unemployment Insurance Tax Ask Gusto

A Complete Guide To California Payroll Taxes Rjs Law

Understanding California Payroll Tax

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate